Islamic banking is defined as a banking system, which is in consonance with the spirit, ethos and value system of Islam and governed by the principles laid down by the Shari’ah. Interest free banking is a narrow concept denoting a number of banking instruments or operations which avoid interest.

Islamic banking, the more general term, is based not only to avoid interest-based transactions prohibited in Shari’ah but also to avoid unethical and un-social practices. In practical sense, Islamic Banking is the transformation of conventional money lending into transactions based on tangible assets and real services.

The model of Islamic banking system leads towards the achievement of a system which helps achieve economic prosperity.

The word “Riba” means excess, increase or addition, which correctly interpreted according to Shari’ah terminology, implies any excess compensation without due consideration (consideration does not include time value of money). This definition of Riba is derived from the Quran and is unanimously accepted by all Islamic scholars.

The Status of Riba has been clarified in the following verses of Quran (Surah Al Baqarah 2:278-9)

“O those who believe; fear Allah and give up what still remains of the Riba if you are believers. But if you do not do so, then be warned of war from Allah and His Messenger. If you repent even now, you have the right of the return of your principal; neither will you do wrong nor will you be wronged.”

The philosophy of Islamic banking takes the lead from Islamic Shari’ah. According to Islamic Shari’ah, Islamic banking cannot deal in transactions involving interest/riba (an increase stipulated or sought over the principal of a loan or debt). Further, they cannot deal in the transactions having the element of Gharar1 or Maiser2. Moreover, they cannot deal in any transaction, the subject matter of which is invalid (haram in the eyes of Islam). Islamic banks focus on generating returns through investment tools which are Shari’ah compliant as well. Islamic Shari’ah links the gain on capital with its performance.

Operating within the ambit of Shari’ah, the operations of Islamic banking are based on sharing the risk which may arise through trading and investment activities using contracts of various Islamic modes of finance. The prohibition of a risk free return and permission of trading, as enshrined in the Verse 2:275 of the Holy Quran, makes the financial activities asset-backed in an Islamic set-up with ability to cause ‘value addition’.

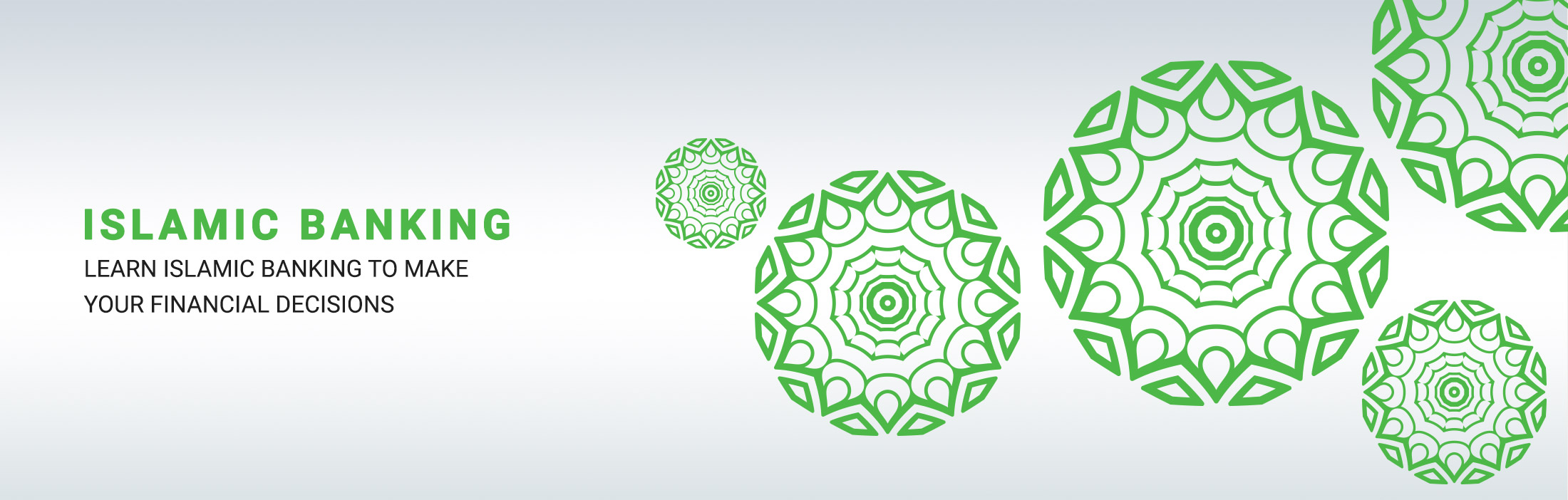

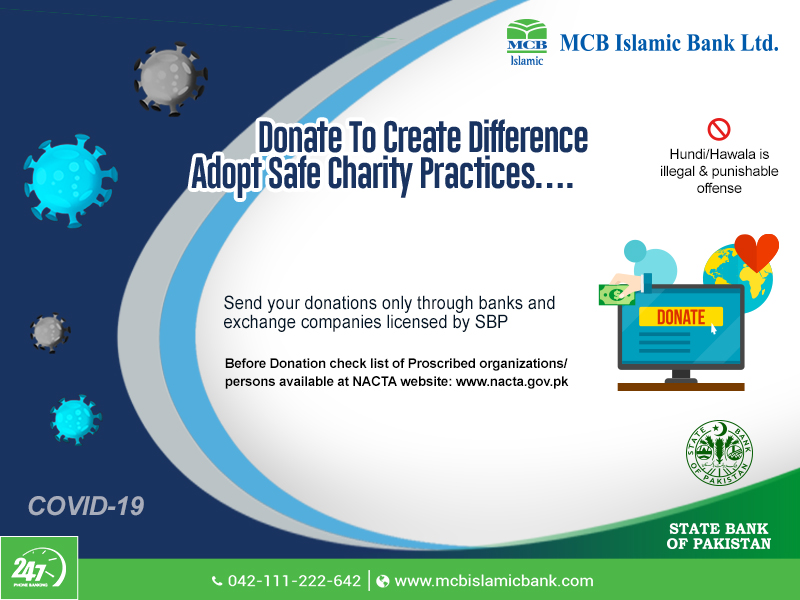

Please use following mode of payments to make your donation for the constructions of Dams:

Watch informative and educational videos about currency notes currently under circulation. These videos will help you identify and differentiate between original and fake notes.

Download Account opening form from the link below, fill it up and present it to your nearest MCB Islamic Bank Ltd. branch.

Detail about required supporting documents can be seen on the below mentioned link:

KHUSHAL AWARENESS AND DEVELOPMENT ORGANIZATION (KADO)

Account Title:

KHUSHAL AWARENESS AND DEVELOPMENT ORGANIZATION (KADO)

Account No.:

0101006867830001

| Debit Card Charges | |||||||

|---|---|---|---|---|---|---|---|

| Fee Type | Visa Classic Debit Card | Visa Gold Debit Card | Visa Juniors Debit Card | Visa Niswaan Debit Card | Visa FCY Debit Card | Visa Platinum Debit Card | Visa Platinum Business Debit Card |

| Annual / Issuance / Renewal / Replacement Fee | 3,400 + FED | 4,150 + FED | 2,700 + FED | 3,650 + FED | USD 12 + FED | 3,600 + FED (Quarterly) | USD 40 + FED |

| Daily Transaction Limits | |||||||

| Transaction Type | Visa Classic Debit Card | Visa Gold Debit Card | Visa Juniors Debit Card | Visa Niswaan Debit Card | Visa FCY Debit Card | Visa Platinum Debit Card | Visa Platinum Business Debit Card |

| Cash Withdrawal Limit | 150,000/ Day | 250,000/ Day | 50,000/ Day | 250,000/ Day | USD 1000/ Day | 400,000/ Day | USD 1,200/ Day |

| POS / Ecommerce Limits | 250,000/ Day | 400,000/ Day | 100,000/ Day | 400,000/ Day | USD 1,500/ Day | 1,000,000/ Day | USD 3,000/ Day |

| IBFT/ Funds Transfer | 500,000/ Day | 1,000,000/ Day | 200,000/ Day | 1,000,000/ Day | N/A | 2,000,000/ Day | N/A |

| Discount Offering | |||||||

| VISA Exclusive Discounts% | Upto 25% | Upto 25% | Upto 25% | Upto 25% | Upto 25% | Upto 50% | Upto 50% |

Your Debit Card application has been submitted and we have sent you a confirmation email. Thank you!

Kindly fill in the below details, our team will contact you shortly.

Kindly fill in the below details, our team will contact you shortly.

Kindly fill in the below details, our team will contact you shortly.

For any further information, please dial 042 111 222 624

* For any further information, please dial 042 111 222 624

Discount:upto25% off

Covid PCR:10% off

Home Sample Collection:100% off

Applicable On:On All Lab Tests

Location:1. High-Q Tower Jail Road, Lahore

2.Lalik Jan chowk, DHA, Phase 2, Lahore

3.Askari x, Lahore

4.Queens road near Ganga Ram Hospital, Lahore

Help line No:021-111-786-986

Valid upto: March 31st, 2025

Discount:upto25% off

Covid PCR:10% off

Home Sample Collection:100% off

Applicable On:On All Lab Tests

Location:1. High-Q Tower Jail Road, Lahore

2.Lalik Jan chowk, DHA, Phase 2, Lahore

3.Askari x, Lahore

4.Queens road near Ganga Ram Hospital, Lahore

Help line No:021-111-786-986

Valid upto: March 31st, 2025

Discount:upto25% off

Covid PCR:10% off

Home Sample Collection:100% off

Applicable On:On All Lab Tests

Location:1. High-Q Tower Jail Road, Lahore

2.Lalik Jan chowk, DHA, Phase 2, Lahore

3.Askari x, Lahore

4.Queens road near Ganga Ram Hospital, Lahore

Help line No:021-111-786-986

Valid upto: March 31st, 2025

Discount:upto25% off

Covid PCR:10% off

Home Sample Collection:100% off

Applicable On:On All Lab Tests

Location:1. High-Q Tower Jail Road, Lahore

2.Lalik Jan chowk, DHA, Phase 2, Lahore

3.Askari x, Lahore

4.Queens road near Ganga Ram Hospital, Lahore

Help line No:021-111-786-986

Valid upto: March 31st, 2025

Discount:upto25% off

Covid PCR:10% off

Home Sample Collection:100% off

Applicable On:On All Lab Tests

Location:1. High-Q Tower Jail Road, Lahore

2.Lalik Jan chowk, DHA, Phase 2, Lahore

3.Askari x, Lahore

4.Queens road near Ganga Ram Hospital, Lahore

Help line No:021-111-786-986

Valid upto: March 31st, 2025

Discount:UP TO 40% (Cap 5000) 25% (Cap 3000)

Applicable On: On Entire Bill

Location: Mei Kong-Outlets

City: Lahore ,Sialkot

Discount:UP TO 40% (Cap 5000) 25% (Cap 3000)

Applicable On: On Entire Bill

Location: Mei Kong-Outlets

City: Lahore ,Sialkot

Discount:UP TO 40% (Cap 5000) 25% (Cap 3000)

Applicable On: On Entire Bill

Location: Mei Kong-Outlets

City: Lahore ,Sialkot

Discount:UP TO 40% (Cap 5000) 25% (Cap 3000)

Applicable On: On Entire Bill

Location: Mei Kong-Outlets

City: Lahore ,Sialkot

Discount:UP TO 40% (Cap 5000) 25% (Cap 3000)

Applicable On: On Entire Bill

Location: Mei Kong-Outlets

City: Lahore ,Sialkot

Discount : Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Plot No. D-6, First, Floor, North Nazimabad, Block-D, Karachi

Saba Arcade, Plot A-125,Block-A, SMCHS, Karachi

T&C: Click Here

Discount :Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Plot No. D-6, First, Floor, North Nazimabad, Block-D, Karachi

Saba Arcade, Plot A-125,Block-A, SMCHS, Karachi

T&C: Click Here

Discount :Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Plot No. D-6, First, Floor, North Nazimabad, Block-D, Karachi

Saba Arcade, Plot A-125,Block-A, SMCHS, Karachi

T&C: Click Here

Discount :Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Plot No. D-6, First, Floor, North Nazimabad, Block-D, Karachi

Saba Arcade, Plot A-125,Block-A, SMCHS, Karachi

T&C:Click Here

Discount :Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Plot No. D-6, First, Floor, North Nazimabad, Block-D, Karachi

Saba Arcade, Plot A-125,Block-A, SMCHS, Karachi

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 1500). Gold, Classic, PayPak Cards: 25% (Cap 1000) (All Days)

Location:Kababjees Bakers-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 1500). Gold, Classic, PayPak Cards: 25% (Cap 1000) (All Days)

Location:Kababjees Bakers-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 1500). Gold, Classic, PayPak Cards: 25% (Cap 1000) (All Days)

Location:Kababjees Bakers-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 1500). Gold, Classic, PayPak Cards: 25% (Cap 1000) (All Days)

Location:Kababjees Bakers-Outlets

T&C:Click Here

Discount:Platinum Cards Discount: 40% (Cap 1500). Gold, Classic, PayPak Cards: 25% (Cap 1000) (All Days)

Location:Kababjees Bakers-Outlets

T&C: Click Here

Discount:15% Off Gold/ Classic / Paypak (Cap 3000)

20% off Platinum (Cap 5000)

Applicable On: On Entire Bill

Location: 1. 51, MM Alam Rd, Block B 1 Gulberg III, Lahore

City: Lahore

Valid upto: January 15th, 2025

Discount:15% Off Gold/ Classic / Paypak (Cap 3000)

20% off Platinum (Cap 5000)

Applicable On: On Entire Bill

Location: 1. 51, MM Alam Rd, Block B 1 Gulberg III, Lahore

City: Lahore

Valid Upto: January 15th, 2025

Discount:15% Off Gold/ Classic / Paypak (Cap 3000)

20% off Platinum (Cap 5000)

Applicable On: On Entire Bill

Location: 1. 51, MM Alam Rd, Block B 1 Gulberg III, Lahore

City: Lahore

Valid Upto: January 15th, 2025

Discount:15% Off Gold/ Classic / Paypak (Cap 3000)

20% off Platinum (Cap 5000)

Applicable On: On Entire Bill

Location: 1. 51, MM Alam Rd, Block B 1 Gulberg III, Lahore

City: Lahore

Valid Upto: January 15th, 2025

Discount:15% Off Gold/ Classic / Paypak (Cap 3000)

20% off Platinum (Cap 5000)

Applicable On: On Entire Bill

Location: 1. 51, MM Alam Rd, Block B 1 Gulberg III, Lahore

City: Lahore

Valid Upto: January 15th, 2025

Discount:20% Off Gold/ Paypak (Cap 2000)

30% off Classic(Cap 3000)

40% off Platinum (Cap 4000)

Applicable On: On Entire Bill

Location: 13-A-3 Mian Mehmood Ali Kasoori Road Gulberg III Lahore.

City: Lahore

Valid upto: October 20th, 2025

Discount: 20% Off Gold/ Paypak (Cap 2000)

30% off Classic(Cap 3000)

40% off Platinum (Cap 4000)

Applicable On: On Entire Bill

Location: 13-A-3 Mian Mehmood Ali Kasoori Road Gulberg III Lahore.

City: Lahore

Valid Upto: October 20th, 2025

Discount: 20% Off Gold/ Paypak (Cap 2000)

30% off Classic(Cap 3000)

40% off Platinum (Cap 4000)

Applicable On: On Entire Bill

Location: 13-A-3 Mian Mehmood Ali Kasoori Road Gulberg III Lahore.

City: Lahore

Valid Upto: October 20th, 2025

Discount: 20% Off Gold/ Paypak (Cap 2000)

30% off Classic(Cap 3000)

40% off Platinum (Cap 4000)

Applicable On: On Entire Bill

Location: 13-A-3 Mian Mehmood Ali Kasoori Road Gulberg III Lahore.

City: Lahore

Valid Upto: October 20th, 2025

Discount: 20% Off Gold/ Paypak (Cap 2000)

30% off Classic(Cap 3000)

40% off Platinum (Cap 4000)

Applicable On: On Entire Bill

Location: 13-A-3 Mian Mehmood Ali Kasoori Road Gulberg III Lahore.

City: Lahore

Valid Upto: October 20th, 2025

Discount:Platinum Cards Discount : 40% (Cap 3000) Gold. Classic, PayPak Cards:25% (Cap 2000)

Location:Nationwide

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 3000) Gold. Classic, PayPak Cards:25% (Cap 2000)

Location:Nationwide

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 3000) Gold. Classic, PayPak Cards:25% (Cap 2000)

Location:Nationwide

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 3000) Gold. Classic, PayPak Cards:25% (Cap 2000)

Location:Nationwide

T&C:Click Here

Discount:Platinum Cards Discount : 40% (Cap 3000) Gold. Classic, PayPak Cards:25% (Cap 2000)

Location:Nationwide

T&C: Click Here

Discount (For Defence Raya Members Only): Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Street 1, Defence Raya Golf Resort, Sector M, DHA, Phase6, Lahore

T&C: Click Here

Discount (For Defence Raya Members Only):Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Street 1, Defence Raya Golf Resort, Sector M, DHA, Phase6, Lahore

T&C: Click Here

Discount (For Defence Raya Members Only):Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Street 1, Defence Raya Golf Resort, Sector M, DHA, Phase6, Lahore

T&C: Click Here

Discount (For Defence Raya Members Only):Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Street 1, Defence Raya Golf Resort, Sector M, DHA, Phase6, Lahore

T&C:Click Here

Discount (For Defence Raya Members Only):Platinum Cards Discount :40% (Cap 5000) Gold. Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location:Street 1, Defence Raya Golf Resort, Sector M, DHA, Phase6, Lahore

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Asian Wok-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Asian Wok-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Asian Wok-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Asian Wok-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Asian Wok-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Kababjees-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Kababjees-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Kababjees-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Kababjees-Outlets

T&C:Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Kababjees-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Mocca-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Mocca-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Mocca-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Mocca-Outlets

T&C:Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Mocca-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Steak Away-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Steak Away-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Steak Away-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Steak Away-Outlets

T&C:Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Steak Away-Outlets

T&C: Click Here

Discount:FLAT 25% off

Applicable On: Platinum Cards Discount: 25% (Cap 1,500).Gold, Classic, PayPak Cards:25% (Cap 1,500) (All Days)

Location: Dunkin-Outlets

T&C Click Here

Discount: FLAT 25% off

Applicable On: Platinum Cards Discount: 25% (Cap 1,500).Gold, Classic, PayPak Cards:25% (Cap 1,500) (All Days)

Location: Dunkin-Outlets

T&C Click Here

Discount:FLAT 25 % Off

Applicable On: Platinum Cards Discount: 25% (Cap 1,500).Gold, Classic, PayPak Cards:25% (Cap 1,500) (All Days)

Location: Dunkin-Outlets

T&C Click Here

Discount: FLAT 25% off

Applicable On: Platinum Cards Discount: 25% (Cap 1,500).Gold, Classic, PayPak Cards:25% (Cap 1,500) (All Days)

Location: Dunkin-Outlets

T&C Click Here

Discount: FLAT 25% off

Applicable On: Platinum Cards Discount: 25% (Cap 1,500).Gold, Classic, PayPak Cards:25% (Cap 1,500) (All Days)

Location: Dunkin-Outlets

T&C Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Readings-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Readings-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Readings-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Readings-Outlets

T&C:Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:Readings-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:W by Wasabi -Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:W by Wasabi -Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:W by Wasabi -Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:W by Wasabi -Outlets

T&C:Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location:W by Wasabi -Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location: Ginsoy-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location: Ginsoy-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location: Ginsoy-Outlets

T&C: Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location: Ginsoy-Outlets

T&C:Click Here

Discount: Platinum Cards Discount: 40% (Cap 5000). Gold,Classic,PayPak Cards: 25% (Cap 3000) (All Days)

Location: Ginsoy-Outlets

T&C: Click Here

Discount:Upto 40% off

Applicable On:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location: Fasana Cafe-Outlets

T&C: Click Here

Discount: Upto 40% off

Applicable On:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location: Fasana Cafe-Outlets

T&C: Click Here

Discount: Upto 40 % Off

Applicable On:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location: Fasana Cafe-Outlets

T&C: Click Here

Discount: Upto 40% off

Applicable On:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location: Fasana Cafe-Outlets

T&C: Click Here

Discount: Upto 40% off

Applicable On:Platinum Cards Discount: 40% (Cap 5000). Gold,Classic, PayPak Cards: 25% (Cap 3000) (All Days)

Location: Fasana Cafe-Outlets

T&C: Click Here

Discount:Upto 40% off

Applicable On: Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards:25% (Cap 3,000) (All Days)

Location: Arcadian Cafe-Outlets

T&C Click Here

Discount: Upto 40% off

Applicable On: Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards:25% (Cap 3,000) (All Days)

Location: Arcadian Cafe-Outlets

T&C Click Here

Discount: Upto 40 % Off

Applicable On: Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards:25% (Cap 3,000) (All Days)

Location: Arcadian Cafe-Outlets

T&C Click Here

Discount: Upto 40% off

Applicable On: Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location: Arcadian Cafe-Outlets

T&C Click Here

Discount: Upto 40% off

Applicable On: Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards:25% (Cap 3,000) (All Days)

Location: Arcadian Cafe-Outlets

T&C Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards Discount:25% (Cap 3000) (All Days)

Location:The lost Tribe-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards Discount:25% (Cap 3000) (All Days)

Location:The lost Tribe-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards Discount:25% (Cap 3000) (All Days)

Location:The lost Tribe-Outlets

T&C: Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000). Gold, Classic, PayPak Cards Discount:25% (Cap 3000) (All Days)

Location:The lost Tribe-Outlets

T&C:Click Here

Discount:Platinum Cards Discount: 40% (Cap 5000)Gold, Classic, PayPak Cards Discount:25% (Cap 3000) (All Days)

Location:The lost Tribe-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Rare-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Rare-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Rare-Outlets

T&C: Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Rare-Outlets

T&C:Click Here

Discount:Platinum Cards Discount : 40% (Cap 5000) Gold. Classic, PayPak Cards:25% (Cap 3000) (All Days)

Location:Rare-Outlets

T&C: Click Here

Discount:Platinum Card 20% off. Gold, Classic, PayPak 15% off

Applicable On:upto 20% off on all cards

Location:Metro-Outlets

Discount:Platinum Card 20% off. Gold, Classic, PayPak 15% off

Location:Nationwide

Location:Metro-Outlets

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Café Zouk-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Café Zouk-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Café Zouk-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Café Zouk-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Café Zouk-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Nishat-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Nishat-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Nishat-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Nishat-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Nishat-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Bar B Q Tonight Restaurant-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Bar B Q Tonight Restaurant-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Bar B Q Tonight Restaurant-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Bar B Q Tonight Restaurant-Outlets

T&C:Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Bar B Q Tonight Restaurant-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Chashni-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Chashni-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Chashni-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Chashni-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Chashni-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:California Pizza-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:California Pizza-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:California Pizza-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:California Pizza-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:California Pizza-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:English Tea House-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:English Tea House-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:English Tea House-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:English Tea House-Outlets

T&C:Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:English Tea House-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Freddy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Freddy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Freddy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Freddy-Outlets

T&C:Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Freddy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Applicable On:upto 40% off on all cards

Location:Howdy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Howdy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Howdy-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Lahore

Location:Howdy-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Tuscany Courtyard-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Tuscany Courtyard-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Tuscany Courtyard-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Tuscany Courtyard-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Tuscany Courtyard-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Spice Bazar-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Spice Bazar-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Spice Bazar-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Spice Bazar-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Spice Bazar-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Aylanto-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Aylanto-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Aylanto-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Aylanto-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Aylanto-Outlets

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location: Village Branch Lahore

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location: Village Branch Lahore

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location: Village Branch Lahore

T&C: Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location: Village Branch Lahore

T&C:Click Here

Discount:Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location: Village Branch Lahore

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:PF Chang-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:PF Chang-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:PF Chang-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:PF Chang-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:PF Chang-Outlets

T&C: Click Here

Discount:Up to 20%off 20% off Platinum

15% off (Gold,Classic,Paypak )

Applicable On: On Entire Bill

Location: Phalia Road saat Sira chowk Mandi bahauddin.

City: Mandi bahauddin.

Valid upto: March 31,2025

Discount:Up to 20%off 20% off Platinum

15% off (Gold,Classic,Paypak )

Applicable On: On Entire Bill

Location: Phalia Road saat Sira chowk Mandi bahauddin.

City: Mandi bahauddin.

Valid Upto: March 31,2025

Discount:Up to 20%off 20% off Platinum

15% off (Gold,Classic,Paypak )

Applicable On: On Entire Bill

Location: Phalia Road saat Sira chowk Mandi bahauddin.

City: Mandi bahauddin.

Valid Upto: March 31,2025

Discount:Up to 20%off 20% off Platinum

15% off (Gold,Classic,Paypak )

Applicable On: On Entire Bill

Location: Phalia Road saat Sira chowk Mandi bahauddin.

City: Mandi bahauddin.

Valid Upto: March 31,2025

Discount:Up to 20%off 20% off Platinum

15% off (Gold,Classic,Paypak )

Applicable On: On Entire Bill

Location: Phalia Road saat Sira chowk Mandi bahauddin.

City: Mandi bahauddin.

Valid Upto: March 31,2025

Discount:Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid upto: April 1st, 2025

Discount: Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: April 1st, 2025

Discount: Up to 25 % off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: April 1st, 2025

Discount: Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: April 1st, 2025

Discount: Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: April 1st, 2025

Discount:Pathology 20%off Radiology 10% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid upto: March 31st, 2025

Discount: Pathology 20%off Radiology 10% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: March 31st, 2025

Discount: Pathology 20%off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: March 31st, 2025

Discount: Pathology 20%off Radiology 10% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: March 31st, 2025

Discount: Pathology 20%off Radiology 10% off

Applicable On: On Entire Bill

Location: Nationwide

City: Lahore

Valid Upto: March 31st, 2025

Discount:10% off

Applicable On: New Articles only

Location: Packages Mall, 2nd floor, Lahore

City: Lahore

Valid upto: March 31st, 2025

Discount: 10% off

Applicable On: New Articles only

Location: Packages Mall, 2nd floor, Lahore

City: Lahore

Valid Upto: March 31st, 2025

Discount: 15 % off

Applicable On: New Articles only

Location: Packages Mall, 2nd floor, Lahore

City: Lahore

Valid Upto: March 31st, 2025

Discount: 10% off

Applicable On: New Articles only

Location: Packages Mall, 2nd floor, Lahore

City: Lahore

Valid Upto: March 31st, 2025

Discount: 10% off

Applicable On: New Articles only

Location: Packages Mall, 2nd floor, Lahore

City: Lahore

Valid Upto: March 31st, 2025

Discount:Flat 15 % off Donuts 24/7 Available Cake (Make To Order)

Applicable On: On Entire Bill

Location: Zoom Pump M.M Alam Road Lahore,Esajee’s DHA Y Block Market Lahore, Esajee’s DHA Phase 5 opt Penta Square Lahore, TOTAL Pump MARKHOR DHA Phase 6 Lahore, TOTAL Pump Valencia Town Lahore, Easy Mart Jasmine Mall Bahria Town Lahore,

City: Lahore

Valid upto: April 1st, 2025

Discount: Flat 15 % off Donuts 24/7 Available Cake (Make To Order)

Applicable On: On Entire Bill

Location: Zoom Pump M.M Alam Road Lahore,Esajee’s DHA Y Block Market Lahore, Esajee’s DHA Phase 5 opt Penta Square Lahore, TOTAL Pump MARKHOR DHA Phase 6 Lahore, TOTAL Pump Valencia Town Lahore, Easy Mart Jasmine Mall Bahria Town Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount: 15 % off

Applicable On: On Entire Bill

Location: Zoom Pump M.M Alam Road Lahore,Esajee’s DHA Y Block Market Lahore, Esajee’s DHA Phase 5 opt Penta Square Lahore, TOTAL Pump MARKHOR DHA Phase 6 Lahore, TOTAL Pump Valencia Town Lahore, Easy Mart Jasmine Mall Bahria Town Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount: Flat 15 % off Donuts 24/7 Available Cake (Make To Order)

Applicable On: On Entire Bill

Location: Zoom Pump M.M Alam Road Lahore,Esajee’s DHA Y Block Market Lahore, Esajee’s DHA Phase 5 opt Penta Square Lahore, TOTAL Pump MARKHOR DHA Phase 6 Lahore, TOTAL Pump Valencia Town Lahore, Easy Mart Jasmine Mall Bahria Town Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount: Flat 15 % off Donuts 24/7 Available Cake (Make To Order)

Applicable On: On Entire Bill

Location: Zoom Pump M.M Alam Road Lahore,Esajee’s DHA Y Block Market Lahore, Esajee’s DHA Phase 5 opt Penta Square Lahore, TOTAL Pump MARKHOR DHA Phase 6 Lahore, TOTAL Pump Valencia Town Lahore, Easy Mart Jasmine Mall Bahria Town Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount:Up to 15% off Gold, Classic,Pay pak ) 10 % off Platinum card 15 % off

Applicable On: On Entire Bill

Location: Shop #13,16,17 Mirpur welfare Plaza

City: Mirpur (AK)

Valid upto: December 31st, 2024

Discount: Up to 15% off Gold, Classic,Pay pak ) 10 % off Platinum card 15 % off

Applicable On: On Entire Bill

Location: Shop #13,16,17 Mirpur welfare Plaza

City: Mirpur (AK)

Valid Upto: December 31st, 2024

Discount: 15 % off

Applicable On: On Entire Bill

Location: Shop #13,16,17 Mirpur welfare Plaza

City: Mirpur (AK)

Valid Upto: December 31st, 2024

Discount: Up to 15% off Gold, Classic,Pay pak ) 10 % off Platinum card 15 % off

Applicable On: On Entire Bill

Location: Shop #13,16,17 Mirpur welfare Plaza

City: Mirpur (AK)

Valid Upto: December 31st, 2024

Discount: Up to 15% off Gold, Classic,Pay pak ) 10 % off Platinum card 15 % off

Applicable On: On Entire Bill

Location: Shop #13,16,17 Mirpur welfare Plaza

City: Mirpur (AK)

Valid Upto: December 31st, 2024

Discount:15 % off

Applicable On: On Entire Bill

Location: Phase 7-Plaza 08, Bahria Town, Islamabad

City: Islamabad

Valid upto: January 31st, 2025

Discount: 15 % off

Applicable On: On Entire Bill

Location: Phase 7-Plaza 08, Bahria Town, Islamabad

City: Islamabad

Valid Upto: January 31st, 2025

Discount: 15 % off

Applicable On: On Entire Bill

Location: Phase 7-Plaza 08, Bahria Town, Islamabad

City: Islamabad

Valid Upto: January 31st, 2025

Discount: 15 % off

Applicable On: On Entire Bill

Location: Phase 7-Plaza 08, Bahria Town, Islamabad

City: Islamabad

Valid Upto: January 31st, 2025

Discount: 15 % off

Applicable On: On Entire Bill

Location: Phase 7-Plaza 08, Bahria Town, Islamabad

City: Islamabad

Valid Upto: January 31st, 2025

Discount:Up to 15 % off

Applicable On: On Entire Bill

Location: Cannal bank Society & Shalimar link road

City: Lahore i

Valid upto: February 29th, 2025

Discount: Up to 15 % off

Applicable On: On Entire Bill

Location:Cannal bank Society & Shalimar link road

City: Lahore i

Valid Upto: February 29th, 2025

Discount: Up to 15 % off

Applicable On: On Entire Bill

Location:Cannal bank Society & Shalimar link road

City: Lahore i

Valid Upto: February 29th, 2025

Discount: Up to 15 % off

Applicable On: On Entire Bill

Location:Cannal bank Society & Shalimar link road

City: Lahore i

Valid Upto: February 29th, 2025

Discount: Up to 15 % off

Applicable On: On Entire Bill

Location:Cannal bank Society & Shalimar link road

City: Lahore i

Valid Upto: February 29th, 2025

Discount:10% off only Books items

Applicable On: On Entire Bill

Location: F-6 Markaz, Islamabad

City: Islamabad

Valid upto: March 31st, 2025

Discount: 10% off only Books items

Applicable On: On Entire Bill

Location: F-6 Markaz, Islamabad

City: Islamabad

Valid Upto: March 31st, 2025

Discount: 10% off

Applicable On: On Entire Bill

Location: F-6 Markaz, Islamabad

City: Islamabad

Valid Upto: March 31st, 2025

Discount: 10% off only Books items

Applicable On: On Entire Bill

Location: F-6 Markaz, Islamabad

City: Islamabad

Valid Upto: March 31st, 2025

Discount: 10% off only Books items

Applicable On: On Entire Bill

Location: F-6 Markaz, Islamabad

City: Islamabad

Valid Upto: March 31st, 2025

Discount:Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Allama Iqbal Town, Hunza Block Allama Iqbal Town, Lahore,

City: Lahore

Valid upto: April 1st, 2025

Discount: Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Allama Iqbal Town, Hunza Block Allama Iqbal Town, Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount: Up to 25 % off

Applicable On: On Entire Bill

Location: Allama Iqbal Town, Hunza Block Allama Iqbal Town, Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount: Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Allama Iqbal Town, Hunza Block Allama Iqbal Town, Lahore,

City: Lahore i

Valid Upto: April 1st, 2025

Discount: Up to 25 % off (Gold,Classic,Paypak) 20% off Platinum Card 25% off

Applicable On: On Entire Bill

Location: Allama Iqbal Town, Hunza Block Allama Iqbal Town, Lahore,

City: Lahore

Valid Upto: April 1st, 2025

Discount: Platnium Card 70% off (Max cap 3000). Gold, Classic, PayPak 50% off (Max cap 2000)

Location:Nationwide

T&C: Click Here

Discount: Platnium Card 70% off (Max cap 3000). Gold, Classic, PayPak 50% off (Max cap 2000)

Location:Nationwide

T&C: Click Here

Discount: Platnium Card 70% off (Max cap 3000). Gold, Classic, PayPak 50% off (Max cap 2000)

Location:Nationwide

T&C: Click Here

Discount: Platnium Card 70% off (Max cap 3000). Gold, Classic, PayPak 50% off (Max cap 2000)

Location:Nationwide

T&C:Click Here

Discount: Platnium Card 70% off (Max cap 3000). Gold, Classic, PayPak 50% off (Max cap 2000)

Location:Nationwide

T&C: Click Here

Discount:20%off Lab & Radiology

Applicable On:On All Lab Tests

Location:Nationwide

Help line No:051-831-1000/0300-0503667

Valid upto: March 31st, 2025

Discount:20%off Lab & Radiology

Applicable On:On All Lab Tests

Location:Nationwide

Help line No:051-831-1000/0300-0503667

Valid upto: March 31st, 2025

Discount:20%off Lab & Radiology

Applicable On:On All Lab Tests

Location:Nationwide

Help line No:051-831-1000/0300-0503667

Valid upto: March 31st, 2025

Discount:20%off Lab & Radiology

Applicable On:On All Lab Tests

Location:Nationwide

Help line No:051-831-1000/0300-0503667

Valid upto: March 31st, 2025

Discount:20%off Lab & Radiology

Applicable On:On All Lab Tests

Location:Nationwide

Help line No:051-831-1000/0300-0503667

Valid upto: March 31st, 2025

Discount: 10%off-On Minimum order 1000/-

Applicable On: Discount on Total Amount Bill

Location: Wahdat Rd/DHA Phase2/Shalimar Bagh/Garhi Shahu

City: Lahore

Valid upto: March 31st, 2025

Discount: 10%off-On Minimum order 1000/-

Applicable On: Discount on Total Amount Bill

Location: Wahdat Rd/DHA Phase2/Shalimar Bagh/Garhi Shahu

City: Lahore

Valid Upto: March 31st, 2025

Discount: 10%off-On Minimum order 1000/-

Applicable On: Discount on Total Amount Bill

Location: Wahdat Rd/DHA Phase2/Shalimar Bagh/Garhi Shahu

City: Lahore

Valid Upto: March 31st, 2025

Discount: 10%off-On Minimum order 1000/-

Applicable On: Discount on Total Amount Bill

Location: Wahdat Rd/DHA Phase2/Shalimar Bagh/Garhi Shahu

City: Lahore

Valid Upto: March 31st, 2025

Discount: 10%off-On Minimum order 1000/-

Applicable On: Discount on Total Amount Bill

Location: Wahdat Rd/DHA Phase2/Shalimar Bagh/Garhi Shahu

City: Lahore

Valid Upto: March 31st, 2025

Discount: Lab Test ( All in-house) 35%off

Radiology 25%off IPD/OPD/Consultations 10%off

Applicable On: On All Lab Tests

Location: General Apartments12-D-8 Markaz, Islamabad

City: Islamabad

Valid upto: March 21st, 2025

Discount: Lab Test ( All in-house) 35%off

Radiology 25%off IPD/OPD/Consultations 10%off

Applicable On: On All Lab Tests

Location: General Apartments12-D-8 Markaz, Islamabad

City: Islamabad

Valid Upto: March 21st, 2025

Discount: Lab Test ( All in-house) 35%off

Radiology 25%off IPD/OPD/Consultations 10%off

Applicable On: On All Lab Tests

Location: General Apartments12-D-8 Markaz, Islamabad

City: Islamabad

Valid Upto: March 21st, 2025

Discount: Lab Test ( All in-house) 35%off

Radiology 25%off IPD/OPD/Consultations 10%off

Applicable On: On All Lab Tests

Location: General Apartments12-D-8 Markaz, Islamabad

City: Islamabad

Valid Upto: March 21st, 2025

Discount: Lab Test ( All in-house) 35%off

Radiology 25%off IPD/OPD/Consultations 10%off

Applicable On: On All Lab Tests

Location: General Apartments12-D-8 Markaz, Islamabad

City: Islamabad

Valid Upto: March 21st, 2025

Discount:Platnium Card 40% off. Gold, Classic, PayPak 25% off

Location:BamBou-Outlets

T&C: Click Here

Discount:Platnium Card 40% off. Gold, Classic, PayPak 25% off

Location:BamBou-Outlets

T&C: Click Here

Discount:Platnium Card 40% off. Gold, Classic, PayPak 25% off

Location:BamBou-Outlets

T&C: Click Here

Discount:Platnium Card 40% off. Gold, Classic, PayPak 25% off

Location:BamBou-Outlets

T&C:Click Here

Discount:Platnium Card 40% off. Gold, Classic, PayPak 25% off

Location:BamBou-Outlets

T&C: Click Here

Discount:20% off on entire menu

Applicable On:20% off on all cards

Location:Lahore

Valid upto: March 31st, 2025

Discount:20% off on entie menu

Applicable On:20% off on all cards

Location:Lahore

Valid upto: March 31st, 2025

Discount:20% off entie menu

Applicable On:20% off on all cards

Location:Lahore

Valid upto: March 31st, 2025

Discount:

Applicable On:20% off on all cards

Location:Lahore

Valid upto: March 31st, 2025

Discount:

Applicable On:20% off on all cards

Location:Lahore

Valid upto: March 31st, 2025

Discount:Upto 30% off

Applicable On:25% discount on domestic and International Tour Pakage

5% Discount Domestic Flight 30%

Discount on Travel insurance

Location:1st floor Hajvairy Tower Chouburji Lahore

City: Lahore

Valid upto: March 31st, 2025

Discount:Upto 30% off

Applicable On: 25% discount on domestic and International Tour Pakage

5% Discount Domestic Flight 30%

Discount on Travel insurance

Location:1st floor Hajvairy Tower Chouburji Lahore

City: Lahore

Valid upto: March 31st, 2025

Discount: Upto 30% off

Applicable On:25% discount on domestic and International Tour Pakage

5% Discount Domestic Flight 30%

Discount on Travel insurance

Location: 1st floor Hajvairy Tower Chouburji Lahore

City: Lahore

Valid upto: March 31st, 2025

Discount:Upto 30% off

Applicable On: 25% discount on domestic and International Tour Pakage

5% Discount Domestic Flight 30%

Discount on Travel insurance

Location: 1st floor Hajvairy Tower Chouburji Lahore

City: Lahore

Valid upto: March 31st, 2025

Discount: Upto 30% off

Applicable On:25% discount on domestic and International Tour Pakage

5% Discount Domestic Flight 30%

Discount on Travel insurance

Location: 1st floor Hajvairy Tower Chouburji Lahore

City: Lahore

Valid upto: March 31st, 2025

Discount:10%off Gold,Classic,Paypak

20%off Platinum card

Applicable On:On All Lab Test

Location: Askari 1 Lahore Cantt,PC Hotel

Society Hospital, Choubarji Chowk

City: Lahore

Valid upto: March 31st, 2025

Discount:10%off Gold,Classic,Paypak

20%off Platinum card

Applicable On: On All Lab Test

Location: Askari 1 Lahore Cantt,PC Hotel

Society Hospital, Choubarji Chowk

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On:On All Lab Test

Location: Askari 1 Lahore Cantt,PC Hotel

Society Hospital, Choubarji Chowk

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: On All Lab Test

Location: Askari 1 Lahore Cantt,PC Hotel

Society Hospital, Choubarji Chowk

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: On All Lab Test

Location: Askari 1 Lahore Cantt,PC Hotel

Society Hospital, Choubarji Chowk

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: Menu Items only

Location: Gulberg

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: Menu Items only

Location: Gulberg

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: Menu Items only

Location: Gulberg

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: Menu Items only

Location: Gulberg

City: Lahore

Valid upto: March 31st, 2025

Discount: 15% Gold/Classic/Paypak

25% Platinum card

Applicable On: Menu Items only

Location: Gulberg

City: Lahore

Valid upto: March 31st, 2025

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Rinas Kitchenette-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Rinas Kitchenette-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Rinas Kitchenette-Outlets

T&C: Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Rinas Kitchenette-Outlets

T&C:Click Here

Discount: Platinum Card 40% off. Gold, Classic, PayPak 25% off

Location:Rinas Kitchenette-Outlets

T&C: Click Here

Discount:Up to 20 % off

Applicable On:Discount on Entire Menu(Except Deal)

Location:Karachi University Housing Society Sector 17 A Gulzar E Hijri Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off

Applicable On:Discount on Entire bil

Location:Karachi University Housing Society Sector 17 A Gulzar E Hijri Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off

Applicable On:Discount on Entire bill

Location:Karachi University Housing Society Sector 17 A Gulzar E Hijri Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off

Applicable On:Discount on Entire bill

Location:Karachi University Housing Society Sector 17 A Gulzar E Hijri Scheme 33, Karachi,

City:Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off

Applicable On:Discount on Entire bill

Location:Karachi University Housing Society Sector 17 A Gulzar E Hijri Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire Menu(Except Deal)

Location:A-K Apartment Plot No. Commercial-8/11 Sector No.38/A Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bil

Location:A-K Apartment Plot No. Commercial-8/11 Sector No.38/A Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bill

Location:A-K Apartment Plot No. Commercial-8/11 Sector No.38/A Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bill

Location:A-K Apartment Plot No. Commercial-8/11 Sector No.38/A Scheme 33, Karachi,

City:Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bill

Location:A-K Apartment Plot No. Commercial-8/11 Sector No.38/A Scheme 33, Karachi,

City: Karachi

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire Menu(Except Deal)

Location:Commercial CP 65, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bil

Location:Commercial CP 65, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bill

Location:Commercial CP 65, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bill

Location:Commercial CP 65, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City:Lahore

Valid upto: December 31st, 2024

Discount:Up to 20 % off Cap (3000) GOLD/Classic/Paypak 15% off Platinum Card 20% off

Applicable On:Discount on Entire bill

Location:Commercial CP 65, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid upto: December 31st, 2024

Discount:15 % off Laboratory Imaging

Applicable On:Discount on Entire Menu(Except Deal)

Location:All Outlest

City: Lahore & Islamabad

Valid upto: December 31st, 2024

Discount:15 % off Laboratory Imaging

Applicable On:Discount on Entire bil

Location:All Outlest

City: Lahore & Islamabad

Valid upto: December 31st, 2024

Discount:15 % off Laboratory Imaging

Applicable On:Discount on Entire bill

Location:All Outlest

City: Lahore & Islamabad

Valid upto: December 31st, 2024

Discount:15 % off Laboratory Imaging

Applicable On:Discount on Entire bill

Location:All Outlest

City:Lahore & Islamabad

Valid upto: December 31st, 2024

Discount:15 % off Laboratory Imaging

Applicable On:Discount on Entire bill

Location:All Outlest

City: Lahore & Islamabad

Valid upto: December 31st, 2024

Discount:Flat 15% off

Applicable On:Discount on Entire Menu(Except Deal)

Location:47, Block-T Gulberg-II, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount:Flat 15% off

Applicable On:Discount on Entire bil

Location:47, Block-T Gulberg-II, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount:Flat 15% off

Applicable On:Discount on Entire bill

Location:47, Block-T Gulberg-II, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount:Flat 15% off

Applicable On:Discount on Entire bill

Location:47, Block-T Gulberg-II, Lahore

City:Lahore

Valid upto: December 31st, 2024

Discount:Flat 15% off

Applicable On:Discount on Entire bill

Location:47, Block-T Gulberg-II, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount: Flat 20% Off

Applicable On:On Entire Bill

Location: Street 29, Block M Model Town, Lahore,

City: Lahore

Valid upto: August 31st, 2024

Discount:Flat 20% Off

Applicable On:On Entire Bill

Location: Street 29, Block M Model Town, Lahore,

City: Lahore

Valid Upto: August 31st, 2024

Discount:Flat 20% Off

Applicable On:On Entire Bill

Location: Street 29, Block M Model Town, Lahore,

City: Lahore

Valid Upto: August 31st, 2024

Discount:Flat 20% Off

Applicable On:On Entire Bill

Location: Street 29, Block M Model Town, Lahore,

City: Lahore

Valid Upto: August 31st, 2024

Discount:Flat 20% Off

Applicable On:On Entire Bill

Location: Street 29, Block M Model Town, Lahore,

City: Lahore

Valid Upto: August 31st, 2024

Discount: Up 10 % off

Applicable On:On Entire Bill

Location:Canal Bank Housing Scheme Harbanspura, Shahdra Town Road Lahore, Jail Road branch, Barket Town Lahore Branch

City: Lahore

Valid upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Canal Bank Housing Scheme Harbanspura, Shahdra Town Road Lahore, Jail Road branch, Barket Town Lahore Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Canal Bank Housing Scheme Harbanspura, Shahdra Town Road Lahore, Jail Road branch, Barket Town Lahore Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Canal Bank Housing Scheme Harbanspura, Shahdra Town Road Lahore, Jail Road branch, Barket Town Lahore Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Canal Bank Housing Scheme Harbanspura, Shahdra Town Road Lahore, Jail Road branch, Barket Town Lahore Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount: Up 10 % off

Applicable On:On Entire Bill

Location:Johar Town Branch Empress Rod Branch, Walton Road Branch, Township Road Branch Samnabad Road Branch Lahore.

City: Lahore

Valid upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Johar Town Branch Empress Rod Branch, Walton Road Branch, Township Road Branch Samnabad Road Branch Lahore.

City: Lahore

Valid Upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Johar Town Branch Empress Rod Branch, Walton Road Branch, Township Road Branch Samnabad Road Branch Lahore.

City: Lahore

Valid Upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Johar Town Branch Empress Rod Branch, Walton Road Branch, Township Road Branch Samnabad Road Branch Lahore.

City: Lahore

Valid Upto: December 31st, 2024

Discount:Up 10 % off

Applicable On:On Entire Bill

Location: Johar Town Branch Empress Rod Branch, Walton Road Branch, Township Road Branch Samnabad Road Branch Lahore.

City: Lahore

Valid Upto: December 31st, 2024

Discount: Upto 20% off

Applicable On: On Entire Bill (Except Deal)

Location: 1-Club Road (Murree Road Islamabad)

City: Islamabad

Valid upto: December 31st, 2024

Discount: Upto 20% off

Applicable On: On Entire Bill (Except Deal)

Location: 1-Club Road (Murree Road Islamabad)

City: Islamabad

Valid upto: December 31st, 2024

Discount: Upto 20% off

Applicable On: On Entire Bill (Except Deal)

Location: 1-Club Road (Murree Road Islamabad)

City: Islamabad

Valid upto: December 31st, 2024

Discount: Upto 20% off

Applicable On: On Entire Bill (Except Deal)

Location: 1-Club Road (Murree Road Islamabad)

City: Islamabad

Valid upto: December 31st, 2024

Discount: Upto 20% off

Applicable On: On Entire Bill (Except Deal)

Location: 1-Club Road (Murree Road Islamabad)

City: Islamabad

Valid upto: December 31st, 2024

Discount:Upto 20% Off% for Gold card

15%for Classic,Paypak Card

Applicable On: Bakery Items

Location: Lahore

City: Lahore

Valid upto: August 31st, 2024

Discount: Upto 20% Offfor Gold card

15%for Classic,Paypak Card

Applicable On: Bakery Items

Location: Lahore

City: Lahore

Valid Upto: August 31st, 2024

Discount: Upto 20% Offfor Gold card

15%for Classic,Paypak Card

Applicable On: Bakery Items

Location: Lahore

City: Lahore

Valid Upto: August 31st, 2024

Discount: Upto 20% Off for Gold card

15%for Classic,Paypak Card

Applicable On: Bakery Items

Location: Lahore

City: Lahore

Valid Upto: August 31st, 2024

Discount: Upto 20% Off for Gold card

15%for Classic,Paypak Card

Applicable On: Bakery Items

Location: Lahore

City: Lahore

Valid Upto: August 31st, 2024

Discount: 10 % off

Applicable On:On Entire Bill

Location:43-L Javaid Iqbal Street, MM Alam Road, Gulberg lll, Lahore,

City: Lahore

Valid upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 43-L Javaid Iqbal Street, MM Alam Road, Gulberg lll, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 43-L Javaid Iqbal Street, MM Alam Road, Gulberg lll, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 43-L Javaid Iqbal Street, MM Alam Road, Gulberg lll, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 43-L Javaid Iqbal Street, MM Alam Road, Gulberg lll, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount: 7 % off

Applicable On:On Entire Bill

Location:1. Punjab Society Headoffice branch 2. Gulberg Falcon Socity Branch 3. Johar Town Branch Near Khokhar Chowk 4. Bahria Town Branch

City: Lahore

Valid upto: December 31st, 2024

Discount:7 % off

Applicable On:On Entire Bill

Location: 1. Punjab Society Headoffice branch 2. Gulberg Falcon Socity Branch 3. Johar Town Branch Near Khokhar Chowk 4. Bahria Town Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount:7 % off

Applicable On:On Entire Bill

Location: 1. Punjab Society Headoffice branch 2. Gulberg Falcon Socity Branch 3. Johar Town Branch Near Khokhar Chowk 4. Bahria Town Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount:7 % off

Applicable On:On Entire Bill

Location: 1. Punjab Society Headoffice branch 2. Gulberg Falcon Socity Branch 3. Johar Town Branch Near Khokhar Chowk 4. Bahria Town Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount:7 % off

Applicable On:On Entire Bill

Location: 1. Punjab Society Headoffice branch 2. Gulberg Falcon Socity Branch 3. Johar Town Branch Near Khokhar Chowk 4. Bahria Town Branch

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15 % off

Applicable On:on all Menu (Except Deal) 15% off

Location:136, Block B Phase 1 Johar Town, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount:15 % off

Applicable On:on all Menu (Except Deal) 15% off

Location: 136, Block B Phase 1 Johar Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:15 % off

Applicable On:on all Menu (Except Deal) 15% off

Location: 136, Block B Phase 1 Johar Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:15 % off

Applicable On:on all Menu (Except Deal) 15% off

Location: 136, Block B Phase 1 Johar Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:15 % off

Applicable On:on all Menu (Except Deal) 15% off

Location: 136, Block B Phase 1 Johar Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount: 10% off

Applicable On:Cake items

Location: Falcon Complex PAF Falcon Complex Gulberg 3, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount:10% off

Applicable On:Cake items

Location: Falcon Complex PAF Falcon Complex Gulberg 3, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:10% off

Applicable On:Cake items

Location: Falcon Complex PAF Falcon Complex Gulberg 3, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:10% off

Applicable On:Cake items

Location: Falcon Complex PAF Falcon Complex Gulberg 3, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:10% off

Applicable On:Cake items

Location: Falcon Complex PAF Falcon Complex Gulberg 3, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount: Mechanical Labour Charges 15 % off (Spare Parts) 5% off

Applicable On:On Entire Bill

Location:17, Jail Road Lahore / 5 Jail Rd, Jinnah Town, Lahore

City: Lahore

Valid upto: December 31st, 2024

Discount:Mechanical Labour Charges 15 % off (Spare Parts) 5% off

Applicable On:On Entire Bill

Location: 17, Jail Road Lahore / 5 Jail Rd, Jinnah Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:Mechanical Labour Charges 15 % off (Spare Parts) 5% off

Applicable On:On Entire Bill

Location: 17, Jail Road Lahore / 5 Jail Rd, Jinnah Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:Mechanical Labour Charges 15 % off (Spare Parts) 5% off

Applicable On:On Entire Bill

Location: 17, Jail Road Lahore / 5 Jail Rd, Jinnah Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount:Mechanical Labour Charges 15 % off (Spare Parts) 5% off

Applicable On:On Entire Bill

Location: 17, Jail Road Lahore / 5 Jail Rd, Jinnah Town, Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount: 10 % off

Applicable On:On Entire Bill

Location: 1st Floor Plaza No.2 E Sector Commercial DHA 2 Islamabad

City: Islamabad

Valid upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 1st Floor Plaza No.2 E Sector Commercial DHA 2 Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 1st Floor Plaza No.2 E Sector Commercial DHA 2 Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 1st Floor Plaza No.2 E Sector Commercial DHA 2 Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:10 % off

Applicable On:On Entire Bill

Location: 1st Floor Plaza No.2 E Sector Commercial DHA 2 Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:20 % Off

Gold Card (Cap 2500)

Classic Card (Cap 1500)

Paypak Card (Cap 2000)

Platinum Card (Cap 5000)

Applicable On:On Entire Bill

Location:Building no 92, Fairways Raya, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid upto: December 31st, 2024

Discount:20 % Off

Gold Card (Cap 2500)

Classic Card (Cap 1500)

Paypak Card (Cap 2000)

Platinum Card (Cap 5000)

Applicable On:On Entire Bill

Location: Building no 92, Fairways Raya, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount:20 % Off

Gold Card (Cap 2500)

Classic Card (Cap 1500)

Paypak Card (Cap 2000)

Platinum Card (Cap 5000)

Applicable On:On Entire Bill

Location: Building no 92, Fairways Raya, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount:20 % Off

Gold Card (Cap 2500)

Classic Card (Cap 1500)

Paypak Card (Cap 2000)

Platinum Card (Cap 5000)

Applicable On:On Entire Bill

Location: Building no 92, Fairways Raya, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount:20 % Off

Gold Card (Cap 2500)

Classic Card (Cap 1500)

Paypak Card (Cap 2000)

Platinum Card (Cap 5000)

Applicable On:On Entire Bill

Location: Building no 92, Fairways Raya, Defence Raya Golf Resort Sector M DHA Phase 6, Lahore,

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15% off

Applicable On:Discount on Entire Menu

Location: DHA Bahria Town Phase 7, Islamabad

City: Islamabad

Valid upto: December 31st, 2024

Discount:15% off

Applicable On:Discount on Entire Menu

Location: DHA Bahria Town Phase 7, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:15% off

Applicable On:Discount on Entire Menu

Location: DHA Bahria Town Phase 7, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:15% off

Applicable On:Discount on Entire Menu

Location: DHA Bahria Town Phase 7, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:15% off

Applicable On:Discount on Entire Menu

Location: DHA Bahria Town Phase 7, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: upto 25%

Applicable On: On Non-Invasive Treatments Medical Grade Facials Laser Hair Removal Body Contouring

Discount:10% Off Paypak/Classic Card 15% off Gold Card 25% off Platinum Card

Location:At All 3D Lifestyle Clinics 021 111 232 889

Valid upto: September1st, 2024

Discount:upto 25%

Applicable On: On Non-Invasive Treatments Medical Grade Facials Laser Hair Removal Body Contouring

Discount:10% Off Paypak/Classic Card 15% off Gold Card 25% off Platinum Card

Location: At All 3D Lifestyle Clinics 021 111 232 889

Valid Upto: December 31st, 2024

Discount: upto 25%

Applicable On: On Non-Invasive Treatments Medical Grade Facials Laser Hair Removal Body Contouring

Discount:10% Off Paypak/Classic Card 15% off Gold Card 25% off Platinum Card

Location: At All 3D Lifestyle Clinics 021 111 232 889

Valid Upto: December 31st, 2024

Discount:upto 25%

Applicable On: On Non-Invasive Treatments Medical Grade Facials Laser Hair Removal Body Contouring

Discount:10% Off Paypak/Classic Card 15% off Gold Card 25% off Platinum Card

Location: At All 3D Lifestyle Clinics 021 111 232 889

Valid Upto: December 31st, 2024

Discount:upto 25%

Applicable On:On Non-Invasive Treatments Medical Grade Facials Laser Hair Removal Body Contouring

Discount:10% Off Paypak/Classic Card 15% off Gold Card 25% off Platinum Card

Location: At All 3D Lifestyle Clinics 021 111 232 889

Valid Upto: December 31st, 2024

Discount:15%off

Applicable On:on Main Course items only

Location: 29-D Civic Center, Phase IV,Bahria Town Islamabad

City: Islamabad

Valid upto: December 31st, 2024

Discount: 15%off

Applicable On:on Main Course items only

Location: 29-D Civic Center, Phase IV,Bahria Town Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15%off

Applicable On:on Main Course items only

Location: 29-D Civic Center, Phase IV,Bahria Town Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15%off

Applicable On:on Main Course items only

Location: 29-D Civic Center, Phase IV,Bahria Town Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15%off

Applicable On:on Main Course items only

Location: 29-D Civic Center, Phase IV,Bahria Town Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15% off

Applicable On: Laboratory Tests/Services

Location: 31-E Maulana Shaukat Ali Rd, Johar Town

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15% off

Applicable On: Laboratory Tests/Services

Location: 31-E Maulana Shaukat Ali Rd, Johar Town

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15% off

Applicable On: Laboratory Tests/Services

Location: 31-E Maulana Shaukat Ali Rd, Johar Town

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15% off

Applicable On: Laboratory Tests/Services

Location: 31-E Maulana Shaukat Ali Rd, Johar Town

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15% off

Applicable On: Laboratory Tests/Services

31-E Maulana Shaukat Ali Rd, Johar Town: Lahore

City: Lahore

Valid Upto: December 31st, 2024

Discount: 15% off

Medicines:10% off Medical Consultation free

Applicable On:On All Lab Tests

Help line No:(042) 111 500 500

Head office Address:294-Block H-3 Johar Town Lahore

Location: Multiple Branches

City: Lahore

Valid upto: December 31st, 2024

Discount:15% off

Medicines:10% off Medical Consultation free

Applicable On:On All Lab Tests

Help line No:(042) 111 500 500

Head office Address:294-Block H-3 Johar Town Lahore

Location: Multiple Branches

City: Lahore

Valid Upto: December 31st, 2024

Discount:15% off

Medicines:10% off Medical Consultation free

Applicable On:On All Lab Tests

Help line No:(042) 111 500 500

Head office Address:294-Block H-3 Johar Town Lahore

Location: Multiple Branches

City: Lahore

Valid Upto: December 31st, 2024

Discount:15% off

Medicines:10% off Medical Consultation free

Applicable On:On All Lab Tests

Help line No:(042) 111 500 500

Head office Address:294-Block H-3 Johar Town Lahore

Location: Multiple Branches

City: Lahore

Valid Upto: December 31st, 2024

Discount:15% off

Medicines:10% off Medical Consultation free

Applicable On:On All Lab Tests

Help line No:(042) 111 500 500

Head office Address:294-Block H-3 Johar Town Lahore

Location: Multiple Branches

City: Lahore

Valid Upto: December 31st, 2024

Discount:15%off

Applicable On:Discount on Entire Menu

Location: 33-A Corniche Road, Phase 4 Bahria Town, Islamabad

City: Islamabad

Valid upto: December 31st, 2024

Discount: 15%off

Applicable On:Discount on Entire Menu

Location: 33-A Corniche Road, Phase 4 Bahria Town, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15%off

Applicable On:Discount on Entire Menu

Location: 33-A Corniche Road, Phase 4 Bahria Town, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15%off

Applicable On:Discount on Entire Menu

Location: 33-A Corniche Road, Phase 4 Bahria Town, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount: 15%off

Applicable On:Discount on Entire Menu

Location: 33-A Corniche Road, Phase 4 Bahria Town, Islamabad

City: Islamabad

Valid Upto: December 31st, 2024

Discount:15% off Cap (2000) Paypak,Gold,Classic 20% off Cap (3000) Platinum Card

Applicable On: On Entire Bill

Location: 1. Iqbal Avenue Phase 1 Joher Town Lahore 2. Iqbal Avenue Phase-3 Main Canal Bank Road, Lahore

City: Lahore

Valid upto: November 30, 2024

Discount:15% off Cap (2000) Paypak,Gold,Classic 20% off Cap (3000) Platinum Card

Applicable On: On Entire Bill

Location: 1. Iqbal Avenue Phase 1 Joher Town Lahore 2. Iqbal Avenue Phase-3 Main Canal Bank Road, Lahore

City: Lahore

Valid Upto: November 30, 2024

Discount:15% off Cap (2000) Paypak,Gold,Classic 20% off Cap (3000) Platinum Card

Applicable On: On Entire Bill